What Is Commercial Health Insurance

Many small business owners carry the following commercial insurance policies. The government is a business and they have to be insured like any other commercial business.

Ppt Chapter 12 Commercial Insurance Powerpoint Presentation Free Download Id 1673639

Ppt Chapter 12 Commercial Insurance Powerpoint Presentation Free Download Id 1673639

General liability insurance which can cover third-party lawsuits over bodily injuries advertising injuries and property damage.

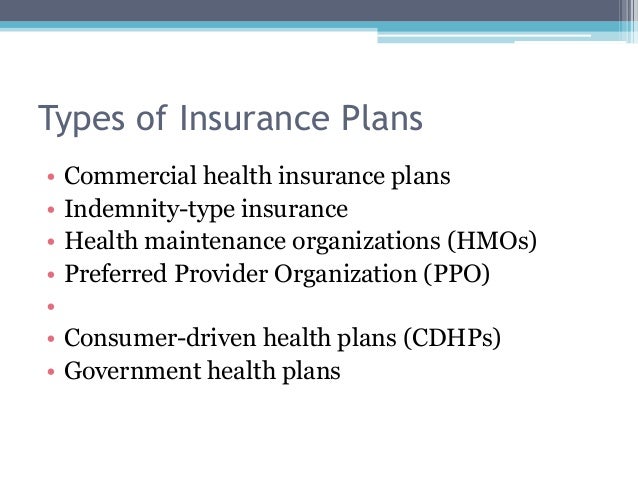

What is commercial health insurance. Medicare Advantage which is a government plan is administered by private insurance companies approved by Medicare. Types of Commercial Health Insurance Health Maintenance Organization. For the most part commercial health insurance is defined as a health insurance plan not administered by the government.

Since there are so many types of businesses with different needs and situations commercial insurance can come in many shapes sizes and colors. Self-employed individuals who do not qualify for employer-sponsored health insurance may deduct premiums on their taxes without itemizing. It covers your medical needs through cost sharing programs that involve premiums co-payments and sometimes deductibles Commercial.

Commercial insurance meets the health care needs of most working people because most workers most of the time do not need a lot of health care. It pays for your care if you get sick or injured as well as preventative care such as vaccines and wellness checkups with. Considerations in choosing a commercial or business insurance policy will always.

What does commercial health insurance mean. TXInsurance May 9 2010. Commercial insurance is required by law in the United States but its easy to get the bare minimum and feel like youre being smart by saving money on something you think you wont need.

Thanks for sharing the information A commercial insurance is a backup support that can be used when situations are adverse and you need an instant solution to recover your loss caused to your business. Insuranceopedia Explains Commercial Insurance. Commercial business insurance is coverage for businesses and corporations generally designed to cover the business its employees and ownership.

Put plainly commercial health insurance is any healthcare policy that is not administered or provided by a government program. If you are using your vehicle in a commercial venture or for hire you must have commercial insurance. PPOs also have a network of physicians but offer policyholders more freedom and.

Dont be surprised if your landlord requires you to have a general liability policy in order to sign a commercial property lease. If youre searching for a plan that offers more flexibility than an. Only Medicare is designed to insulate Americans from.

Also known as private health insurance commercial health insurance is any type of health insurance that is not offered and managed by a government entity. The Complete Guide to Commercial Health Insurance Plans 1. Today were focusing on commercial insurance - a term used across the insurance industry - so what is commercial.

Get commercial insurance explained. HMOs require you to choose a primary care physician PCP in their network. Come across the term but not sure what it means.

The even better news is with good insurance. Most commercial health insurers are publicly traded companies that operate to generate a profit for shareholders. There is no practical difference between commercial and private insurance policies they both protect you financially from liability in the case of an accident.

One of the most common health insurance coverage in the United States are Health. The good news is the many variations of commercial insurance are usually tax write-offs as theyre considered an essential part of doing business. Commercial health insurance is private health insurance that is typically purchased through a for-profit company or.

Some commercial health insurers are non-profit organizations. Coverage may include business property damage loss of income due to a business interruption legal issues theft and employees grievances. Health insurance typically covers the costs of medical prescription and surgical services.

What Does Health Insurance Cover. Commercial insurance refers to a policy that is meant to protect a business from future risks. Companies that sell this type of insurance are for-profit corporations and offer their insurance services through group insurance plans as well as individual or personal plans.

Also known as private-funded insurance these plans primarily are provided through benefits plans provided by employers. Recently weve been clarifying some tricky insurance terms consequential loss and third party liability insurance two of the topics weve tackled so far. In a very short word Yes.

Commercial health insurance is any type of healthcare policy that is not administered through a government program.

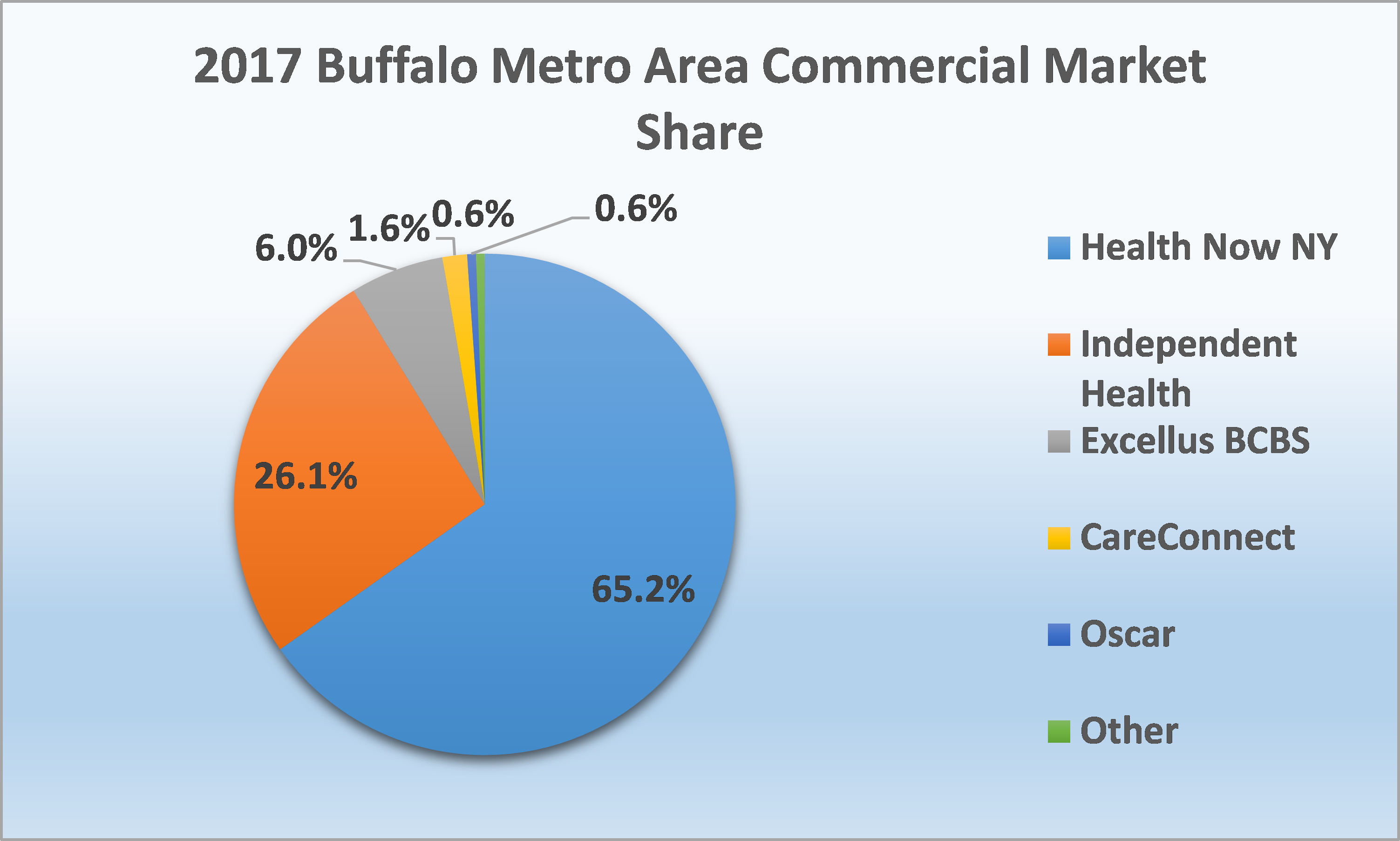

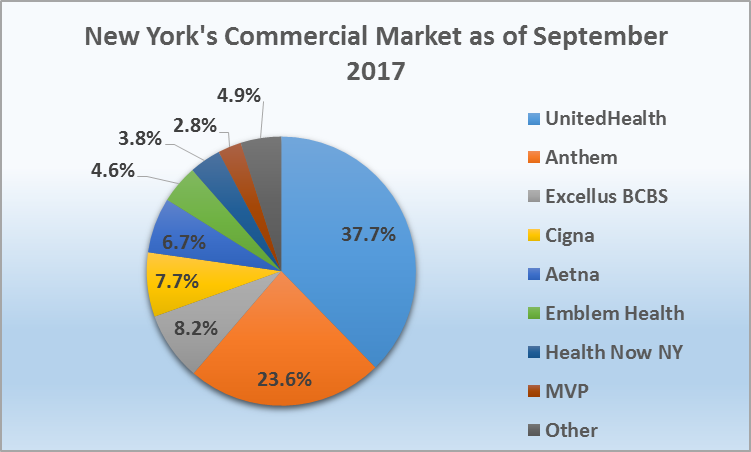

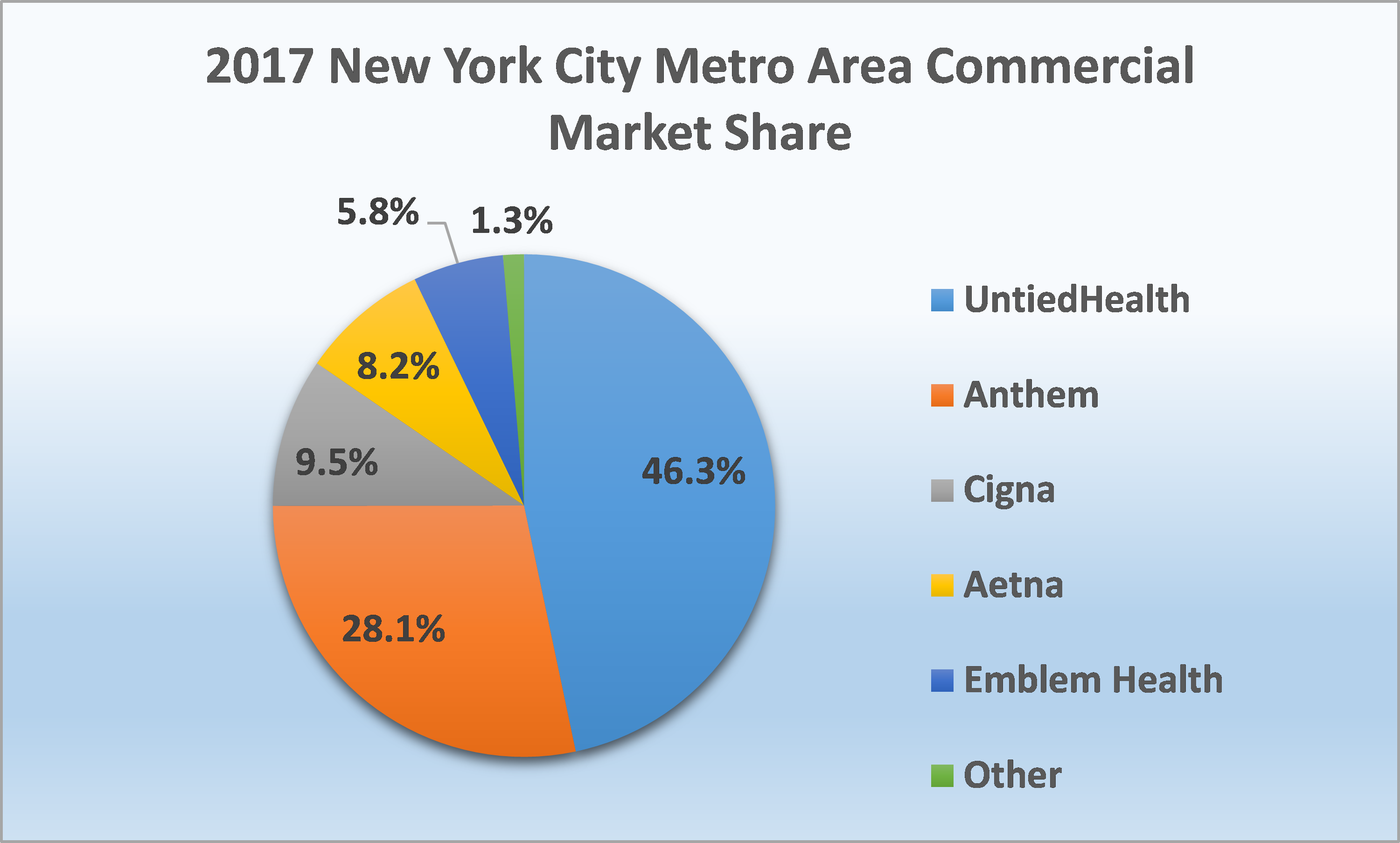

A Brief Look At Commercial Health Insurance Market Share In Select New York Metro Areas

A Brief Look At Commercial Health Insurance Market Share In Select New York Metro Areas

/man-at-the-table-fills-in-the-form-of-health-insurance--healthcare-concept--vector-illustration-flat-design-style--682211990-bcd44344bfb04adc91f0d35376838b10.jpg) Commercial Health Insurance Definition

Commercial Health Insurance Definition

Perspectives In Commercial Health Insurance Leveraging Information A

Perspectives In Commercial Health Insurance Leveraging Information A

A Brief Look At Commercial Health Insurance Market Share In Select New York Metro Areas

A Brief Look At Commercial Health Insurance Market Share In Select New York Metro Areas

Commercial Health Insurance Definition

Commercial Health Insurance Definition

Insurance Dallas Nutrition Therapy

Insurance Dallas Nutrition Therapy

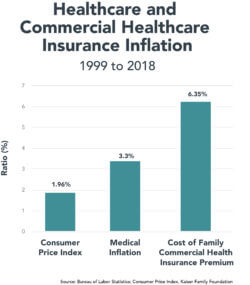

An Unbearable Burden Paying For Commercial Health Insurance 4sight Health 4sight Health

An Unbearable Burden Paying For Commercial Health Insurance 4sight Health 4sight Health

The Research Framework Commercial Health Insurance Company Strategy Download Scientific Diagram

The Research Framework Commercial Health Insurance Company Strategy Download Scientific Diagram

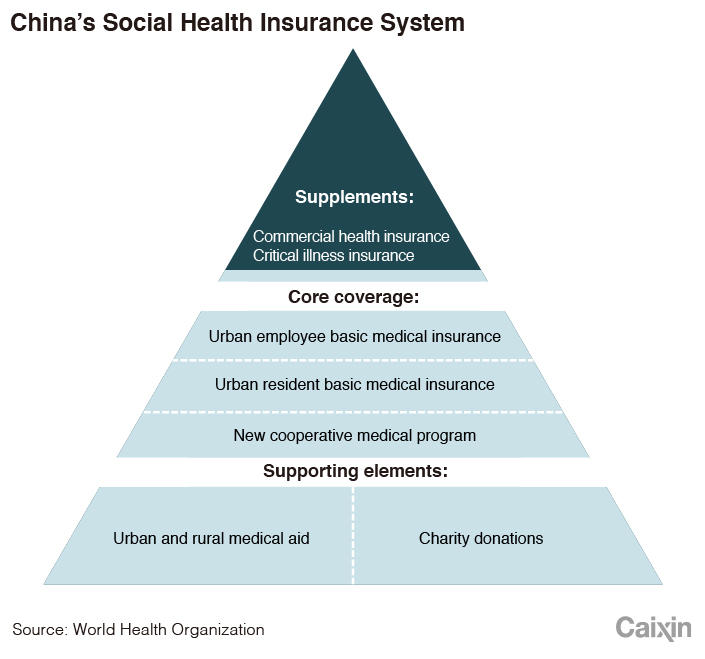

In Depth China S Health Insurance Dilemma Caixin Global

In Depth China S Health Insurance Dilemma Caixin Global

Health Insurance Commercial Health Insurance

Health Insurance Commercial Health Insurance

A Brief Look At Commercial Health Insurance Market Share In Select New York Metro Areas

A Brief Look At Commercial Health Insurance Market Share In Select New York Metro Areas

Study Commercial Health Insurance Concentration Increases Again Aha News

Study Commercial Health Insurance Concentration Increases Again Aha News

China Commercial Health Insurance White Paper The Digital Insurer

China Commercial Health Insurance White Paper The Digital Insurer

Comments

Post a Comment