Individual Mandate Health Insurance

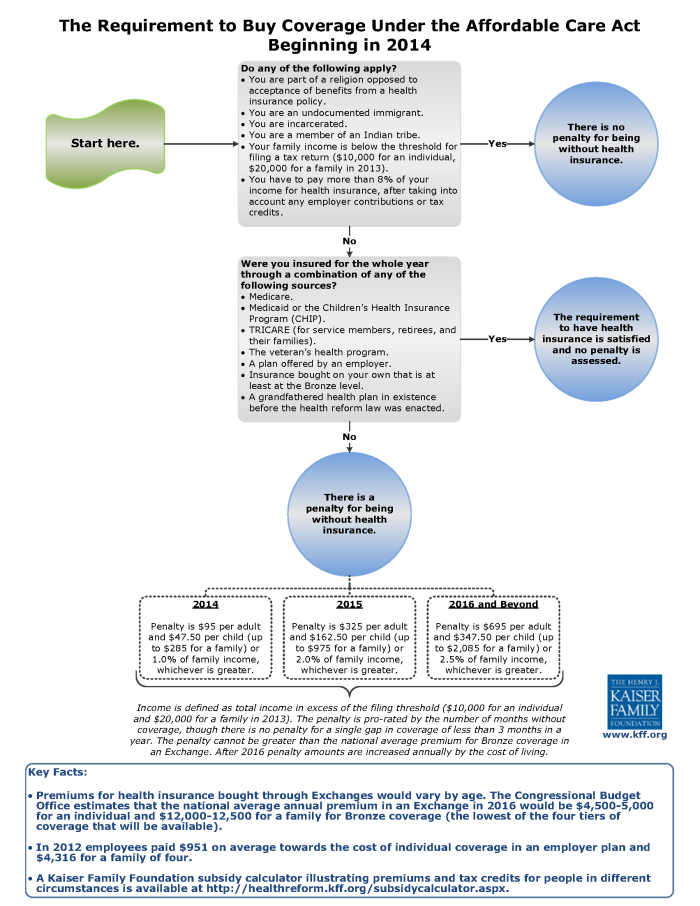

This requirement is commonly referred to as the laws individual mandate The law imposes a tax penalty through 2018 on those who fail to have the required coverage. Most people have to get health insurance under the law whether its from the marketplace your job or directly through an insurer.

The New Tax Law The Individual Health Insurance Mandate Wsj

The New Tax Law The Individual Health Insurance Mandate Wsj

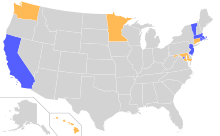

Representatives from these states have explained that individual mandate laws are designed to address not only a public health care concern ensuring that people continue to have health coverage but also to keep their health insurance markets including premiums more stable.

Individual mandate health insurance. In health insurance the individual mandate or shared responsibility payments refer to the penalty or fee charged to people who can afford to buy health insurance but choose not to buy it. In 2010 President Obama passed one of the most comprehensive pieces of healthcare legislation in US history which included an individual mandate requiring every citizen to enroll in health insurance or face a tax penalty. The individual mandate is a provision within the Affordable Care Act that required individuals to purchase minimum essential coverage or face a tax penalty unless they were eligible for an exemption.

The Individual Mandate Penalty. Who was affected by the individual mandate. That means they dont have to have health insurance and dont have to pay the penalty fee for noncompliance.

Why Are States Passing New Individual Mandate Laws. Some states have their own individual health insurance mandate requiring you to have qualifying health coverage or pay a fee with your state taxes for the 2019 plan year. The individual mandate has been suspended and only applies for 2018 and earlier You pay a penalty if you go without qualifying health coverage for a period of three months or more Qualifying coverage includes work-based plans and any plan you buy through the health.

If you live in a state that requires you to have health coverage and you dont have coverage or an exemption. However as part of an effort to repeal the Affordable Care Act President Trump vowed to eliminate the individual mandate. What is the individual mandate.

Affordable Care Acts Coverage Mandate. Under the ACA also called Obamacare Americans who were not otherwise eligible for an exemption were required to have health insurance. Individuals who do not obtain health insurance for themselves and their dependents will be subject to a penalty unless they qualify for an exemption.

The Individual Mandate for Health Insurance Coverage. Without an individual mandate the health insurance market is likely to break down due to the adverse selection problem but such a mandate can place a considerable burden on some households. If the taxpayers still did not pay the penalty the IRS could have attempted to collect the funds.

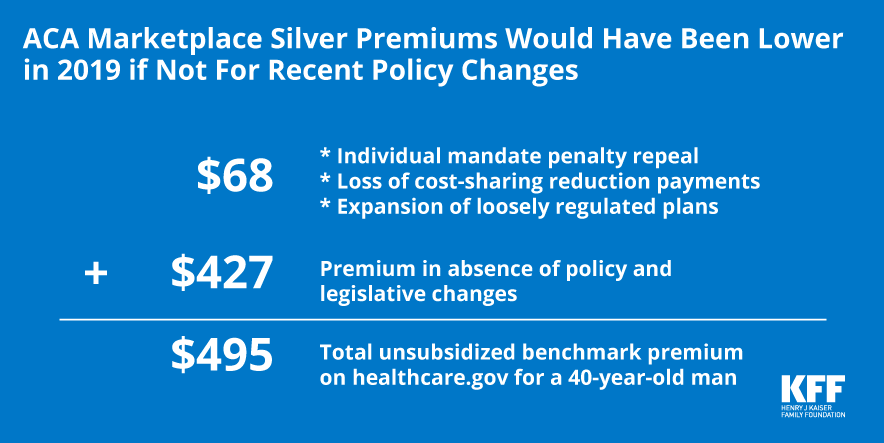

The elimination of the individual mandate penalty in 2019 contributed to higher individual market non-group premiums for 2019 because insurers expected that the people likely to drop their coverage after the penalty was eliminated would be healthy whereas sick people will tend to keep their coverage regardless of whether theres a penalty for being uninsured. The State of California adopted a new state individual health care mandate that requires individuals to maintain health insurance beginning January 1 2020. The health care reform legislation that became law in 2010 - known officially as the Affordable Care Act and also as Obamacare - requires most Americans to have a basic level of health insurance coverage.

Youll be charged a fee when you file your 2019 state taxes. Congress eliminated the federal tax penalty for not having health insurance effective January 1 2019. More information about this change is available here.

In Brief Congressional Research Service 4 For tax years prior to TY2019 taxpayers who were required to pay a penalty but failed to do so would have received a notice from the Internal Revenue Service IRS stating that they owed the penalty. However there are certain groups of people who are exempt from the individual mandate.

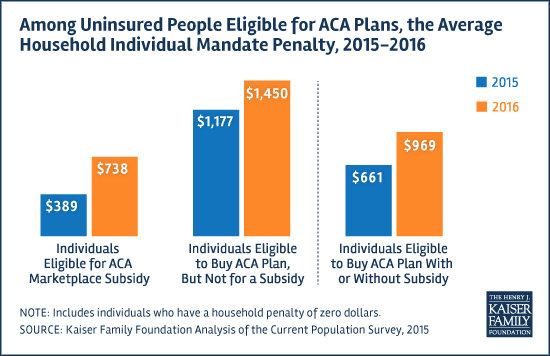

Average Individual Mandate Penalty To Rise 47 Percent To 969 In 2016 For Uninsured People Eligible For Aca Plans Kff

Average Individual Mandate Penalty To Rise 47 Percent To 969 In 2016 For Uninsured People Eligible For Aca Plans Kff

How Does The Aca Individual Mandate Affect Enrollment And Premiums In The Individual Insurance Market Rand

How Does The Aca Individual Mandate Affect Enrollment And Premiums In The Individual Insurance Market Rand

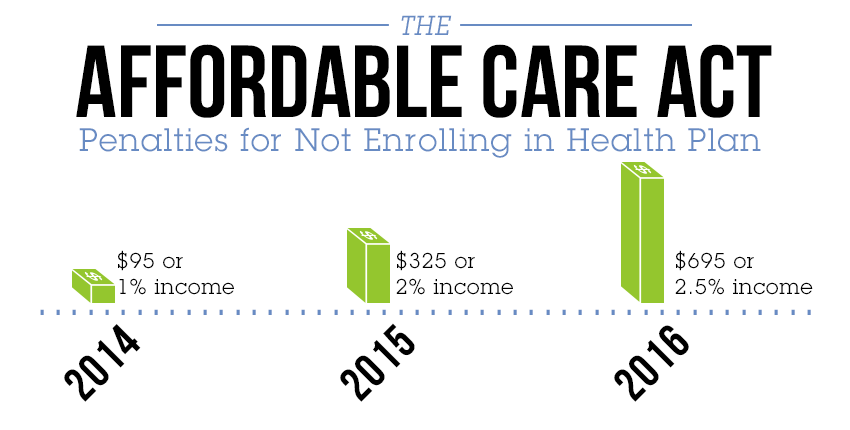

Health Care Reform The Individual Mandate Mnj Insurance Solutions

Health Care Reform The Individual Mandate Mnj Insurance Solutions

How Does The Aca Individual Mandate Affect Enrollment And Premiums In The Individual Insurance Market Rand

How Does The Aca Individual Mandate Affect Enrollment And Premiums In The Individual Insurance Market Rand

How Does The Aca Individual Mandate Affect Enrollment And Premiums In The Individual Insurance Market Rand

How Does The Aca Individual Mandate Affect Enrollment And Premiums In The Individual Insurance Market Rand

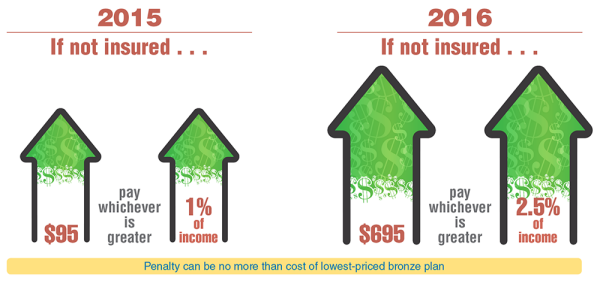

Individual Mandate Requirement To Buy Health Insurance Infographic Find Out If You Ll Owe A Buy Health Insurance Health Insurance Infographic Health Insurance

Individual Mandate Requirement To Buy Health Insurance Infographic Find Out If You Ll Owe A Buy Health Insurance Health Insurance Infographic Health Insurance

![]() Obamacare Individual Mandate Millennium Medical Solutions Inc

Obamacare Individual Mandate Millennium Medical Solutions Inc

Health Insurance Stabilizing Premiums Effectiveness Of The Individual Mandate And Expanding Services Nova Science Publishers

Health Insurance Stabilizing Premiums Effectiveness Of The Individual Mandate And Expanding Services Nova Science Publishers

The Individual Mandate Penalty How To Avoid An Unpleasant Surprise On Your Taxes Point Of Blue

The Individual Mandate Penalty How To Avoid An Unpleasant Surprise On Your Taxes Point Of Blue

Health Care Reform The Individual Mandate Mnj Insurance Solutions

Health Care Reform The Individual Mandate Mnj Insurance Solutions

How Repeal Of The Individual Mandate And Expansion Of Loosely Regulated Plans Are Affecting 2019 Premiums Kff

How Repeal Of The Individual Mandate And Expansion Of Loosely Regulated Plans Are Affecting 2019 Premiums Kff

Comments

Post a Comment