Best Student Loan Repayment Strategy

Skip Guided Questions Step 1 Completed. The golden rule of student loan repayment of course is that you should pay off the student loans with the highest interest rates first.

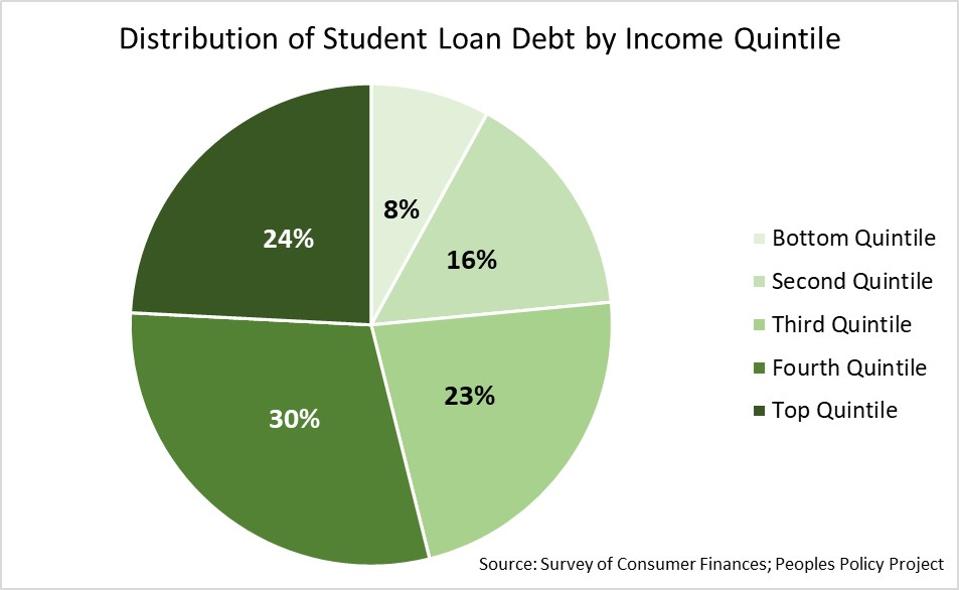

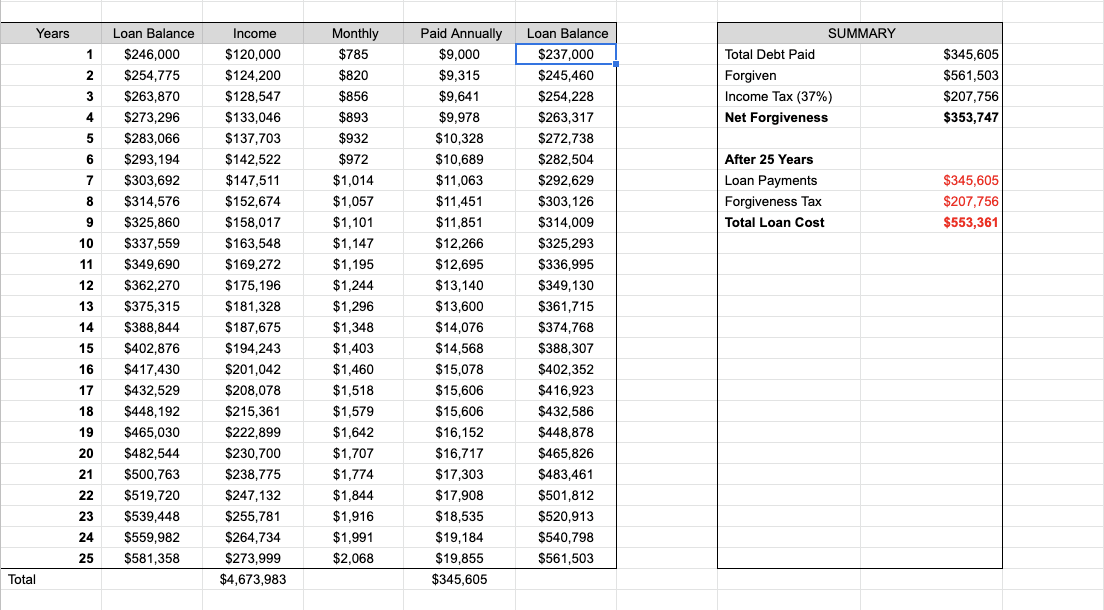

The Case Against Student Loan Forgiveness

The Case Against Student Loan Forgiveness

Student Loan Repayment Strategies Income-Driven Plans.

Best student loan repayment strategy. Here are the six strategies I used to get out of 81000 in student loan debt. Loan Repayment Assistance programs are available through schools government entities and bar associations. We cant provide your repayment options simulation until you select an.

With income-driven repayment plans like Income-Based Repayment IBR Income-Contingent Repayment ICR Pay As You Earn PAYE and Revised Pay As You Earn REPAYE borrowers can pay a percentage. Consolidation may also be an option. There are several tax refund strategies for student loan debt that work for any sort of financial windfall.

The 10 and 20-year numbers are both the lowest available of all the IDR plans. Put at least some of your tax refund andor cash windfalls toward student loan repayment even if you dont want to devote 100. If you fail to make your monthly payments not only will your credit be hurt but you can see your wages garnished and more.

Minimize total repayment cost Youre focused on reducing cost reducing time and saving money overall. When you start repaying your student loan your monthly repayments what to do if you have 2 jobs or are self-employed how to get a refund if youve overpaid. This is the one universal truth about student debt repayment and I am sure that everyone would agree that this strategy should be implemented by all borrowers.

Selecting Your Income-Driven Plan. However it might not make sense to devote extra money to student loans so that other. Find the Best Repayment Strategy.

Select one tile Pay Off My Loans As Fast As Possible. A variety of repayment plans are available including plans based on your income. I used the debt avalanche method.

Arguably the most important aspect of any student loan repayment strategy is to keep a positive can-do attitude. Find the repayment strategy that works for you. Select a Loan Averages Approach.

Borrowers are only expected to pay 10 of their discretionary income and forgiveness comes after 20 years. You must apply for. A variety of repayment plans are available including plans based on your income.

PSLF is probably the best-known forgiveness program but there are multiple avenues of student loan forgiveness. Decide what is most important to you when repaying your student loan debt. StudentLoan Tech will evaluate your personal situation to determine the best possible repayment strategy for your student loans.

For most attorneys either the PAYE or REPAYE program will. Step 2 of 3. Find the Best Repayment Strategy.

Step 3 of 3. The Pay As You Earn Plan PAYE is one of the most popular federal student loan repayment plans. Find the repayment strategy that works for you.

Plus going into default will see your loan balance automatically rise by about 25 due to accrued interest and collection costs. Your options ultimately include. The best way to pay off student loans is to pay more than the minimum each month.

4 What is your primary repayment goal. The more you pay toward your loans the less interest youll owe. But stick with it increase your payments when possible and soon youll build momentum and experience some satisfying results.

Student loan refinancing. Our customized student loan strategies reduce your monthly payments making them more affordable based on your income and personal financial situation. When you refinance a private lender pays off your student loans and issues you a new loan at a lower interest rate.

Borrowers working outside the public service arena are also eligible for forgiveness through income-driven repayment plans. Consolidation may also be an option. So find the student loan repayment plan.

Whether you are in school in grace or in repayment creating a repayment strategy is a great way to efficiently tackle paying off your student loans. When starting out each monthly payment can feel like a drop in an ocean. Once again the best student loan repayment plan is the one that you can afford to make every month.

The implication of a debt-to-income ratio over 15 is that your student loan balance is high enough. A repayment strategy is establishing a repayment plan and identifying any additional actions you may need to. Take a job that offers forgiveness.

Skip Guided Questions Step 1 Completed. My Grad PLUS loans had interest.

Options For Student Loan Repayment Great Lakes

Options For Student Loan Repayment Great Lakes

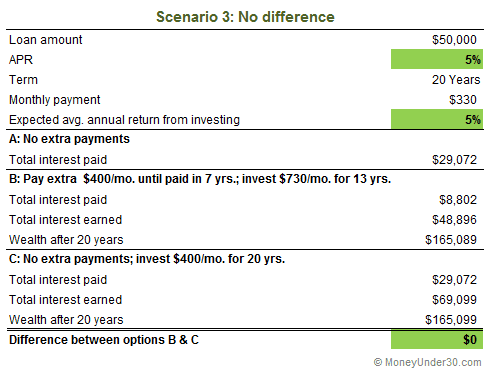

Should You Pay Off Student Loans Early Money Under 30

Should You Pay Off Student Loans Early Money Under 30

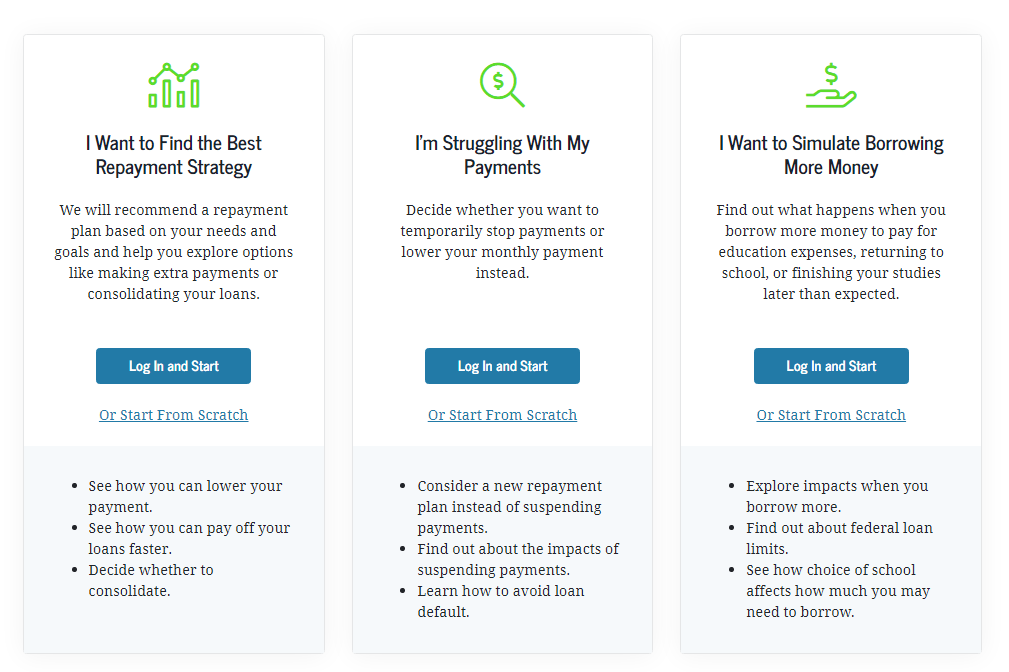

Edvisors Financial Aid Student Loans And College Scholarships

Edvisors Financial Aid Student Loans And College Scholarships

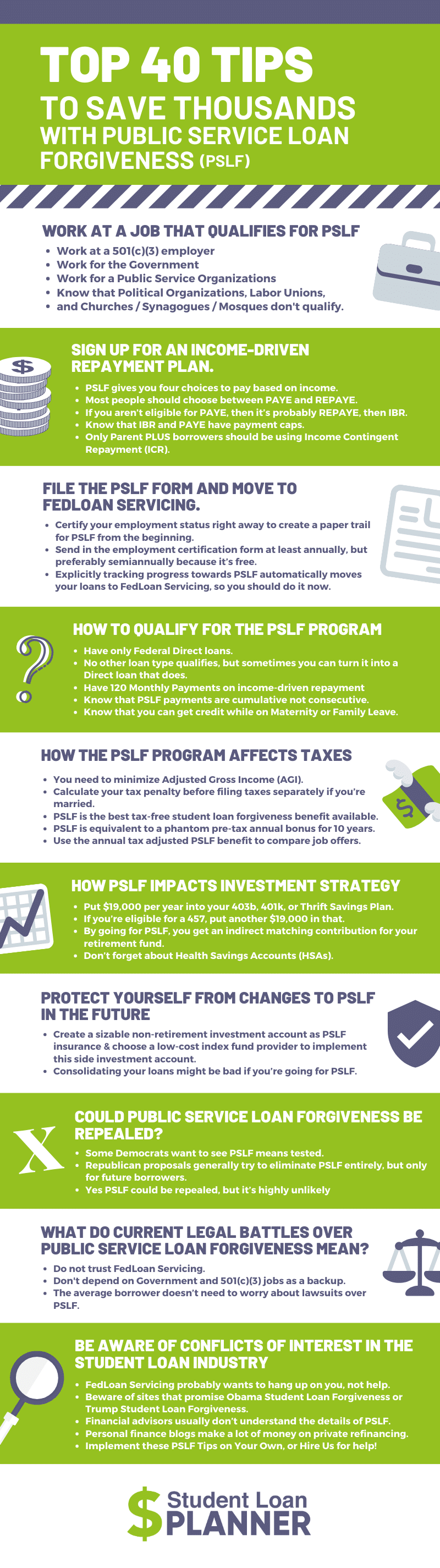

How To Get Public Service Loan Forgiveness 40 Tips For Pslf Help

How To Get Public Service Loan Forgiveness 40 Tips For Pslf Help

Choose Your Student Loan Repayment Strategy By Answering This Question

The Versatile Student Loan Calculator Loan Simulator Fsa

The Versatile Student Loan Calculator Loan Simulator Fsa

A Simple Tool For Creating A Killer Debt Repayment Plan Mom And Dad Money

A Simple Tool For Creating A Killer Debt Repayment Plan Mom And Dad Money

Plain Finances Student Loan Repayment Paying Student Loans Student Loans

Plain Finances Student Loan Repayment Paying Student Loans Student Loans

Student Loan Repayment Options Youtube

Student Loan Repayment Options Youtube

Best Student Loan Repayment Strategy Tips By Occupation Student Loan Planner Podcasts On Audible Audible Com

Best Student Loan Repayment Strategy Tips By Occupation Student Loan Planner Podcasts On Audible Audible Com

4 Smart Student Loan Repayment Strategies For New Grads Sofi

4 Smart Student Loan Repayment Strategies For New Grads Sofi

Best Strategies To Pay Off 100k In Student Loan Debt Student Loan Hero

Best Strategies To Pay Off 100k In Student Loan Debt Student Loan Hero

11 Strategies To Pay Off Student Loans Fast Credible

11 Strategies To Pay Off Student Loans Fast Credible

Comments

Post a Comment