Can I Dispute A Medical Bill In Collections

What are HIPPA violations. They just want you to pay back the debt.

3 Best Ways To Get Help With Medical Bills In 2020 A Free Quick Guide

3 Best Ways To Get Help With Medical Bills In 2020 A Free Quick Guide

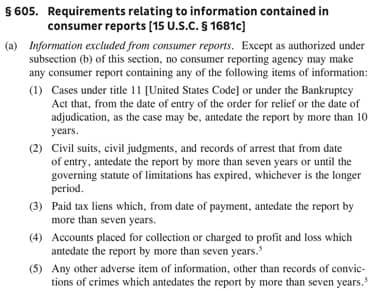

As per NCAP the consumer reporting agencies must follow specific rules for medical debt.

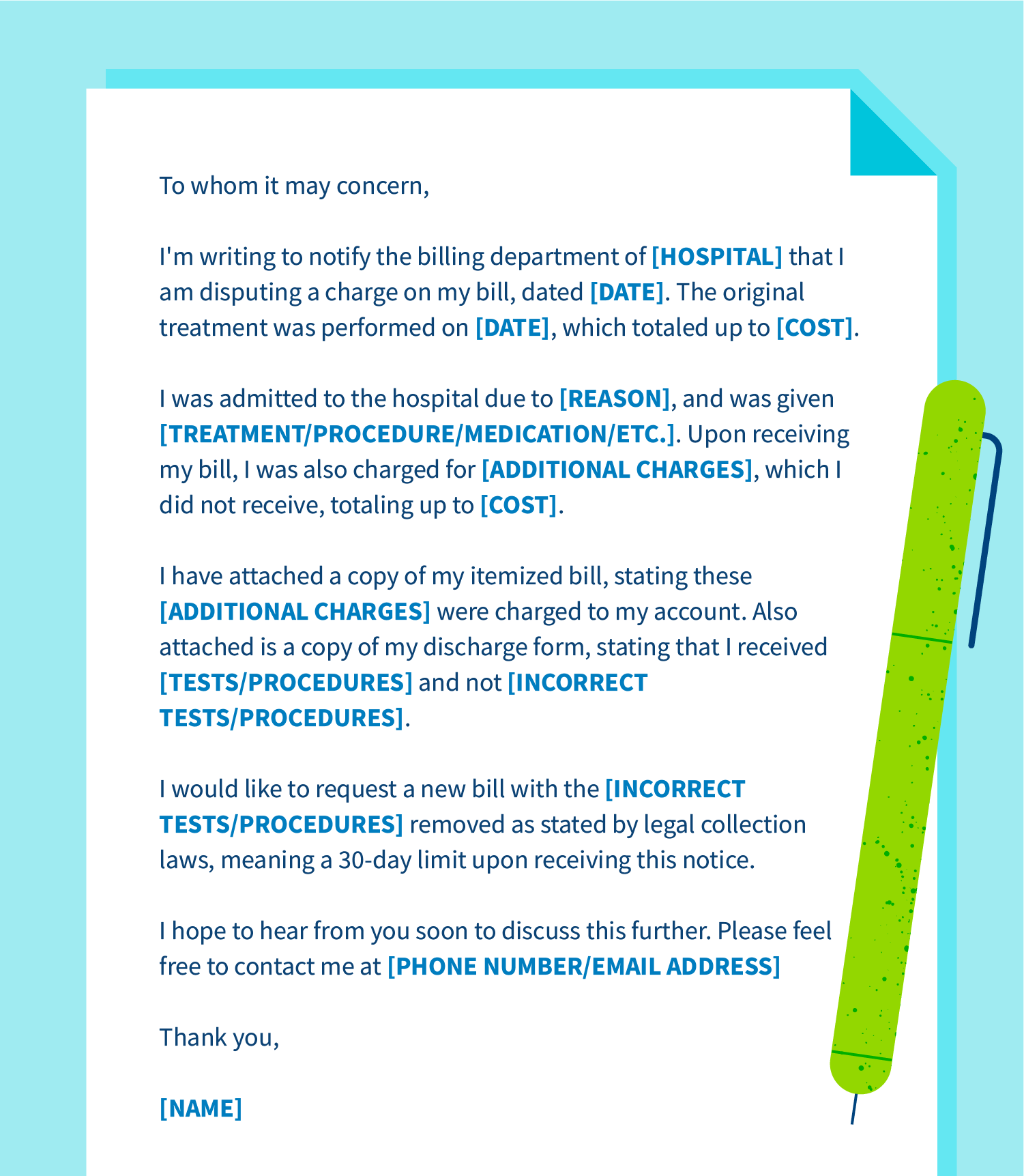

Can i dispute a medical bill in collections. You can dispute a bill but not with the collection agency. Once you do this make sure you tell your healthcare provider that youve filed an appeal. In your letter state that you want the medical collections agency to validate that this unpaid medical debt actually belongs to you.

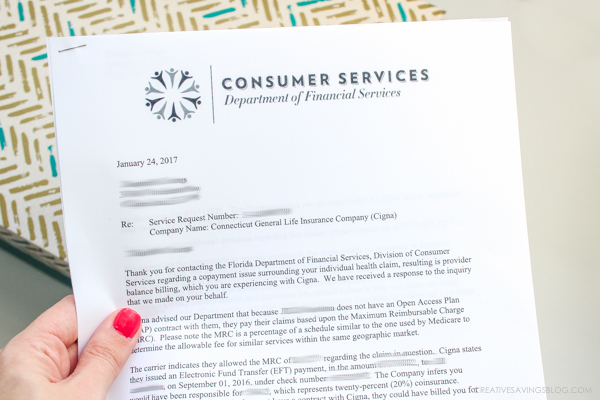

Challenging medical bills can be a hassle but its much better to deal with the problem before it is handed off to a debt collector. The agency must send you the consumer a written notice containing key elements. You want to go online and file a complaint about your Medical Debt Collector on the BBB Website.

Getting medical bills in collections removed from your credit report involves yet another strategy. A 180-day waiting period before the unpaid medical bills can appear Delete any trade line ultimately paid by the consumers health insurance plan. In my case I filed two appeals but both were denied.

They will reach out to the company and typically advocate for consumers. What does this mean. You have the legal right under the FDCPA to request a medical debt validation letter as another bargaining tactic with the collection agency.

How to Dispute Medical Collections. If you are challenging a charge ask the medical provider to hold off sending the bill to collections while you seek a resolution. Heres how you do it.

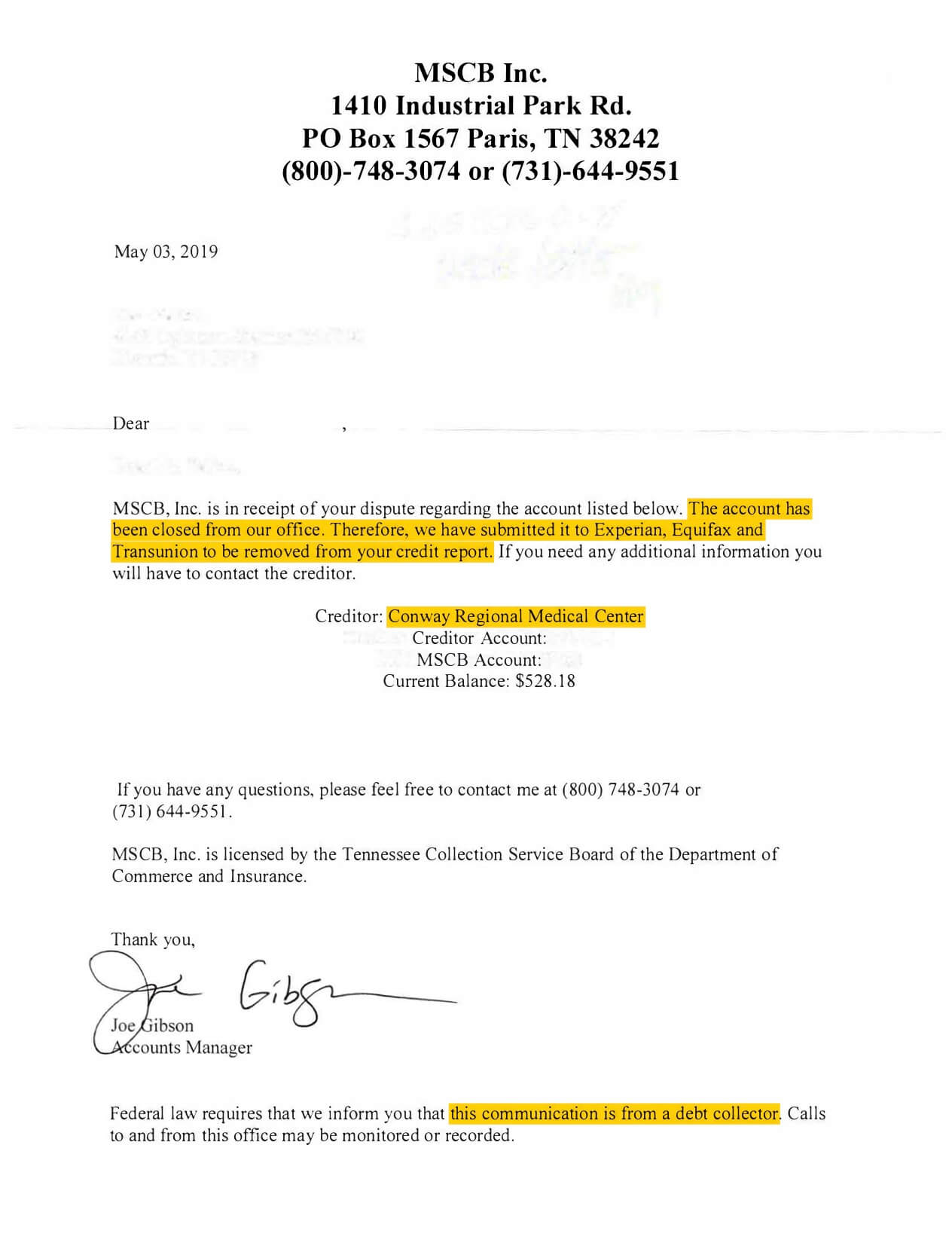

When a medical debt is sold to collections the collection agency that purchased the debt may report the account to one or more of the three credit bureaus Experian TransUnion and Equifax. However medical collections can be inaccurate and if you believe your medical collections were reported inaccurately to the credit bureaus you can dispute them with each credit bureau and may be able to get them removed or updated based on verification from the collection agency. Every bureau has its own disputes page.

If you still have trouble paying your bills there are various laws. Instead the hospital can request for. If the creditor includes any medical details like the procedure when they sell the debt its your right to dispute remove the collections record.

This grace period gives individuals with medical debt six months to resolve any insurance or billing. That did not go over well. I had paid down a large hospital bill to 500.

Experian does not display medical collections on a credit report until they are 180 days past due. If you have a medical bill that you cant pay or a medical bill that has already been sent to collections dont stress. The very first thing you can do when attempting to dispute medical collections in your credit report is to send a letter that will create an actionable paper trail.

There are three main methods of filing a dispute. When a medical bill goes unpaid the creditor has the right to sell your debt to a 3rd party. While TransUnion and Equifax have their own processes for disputing credit reports Experian allows you to do.

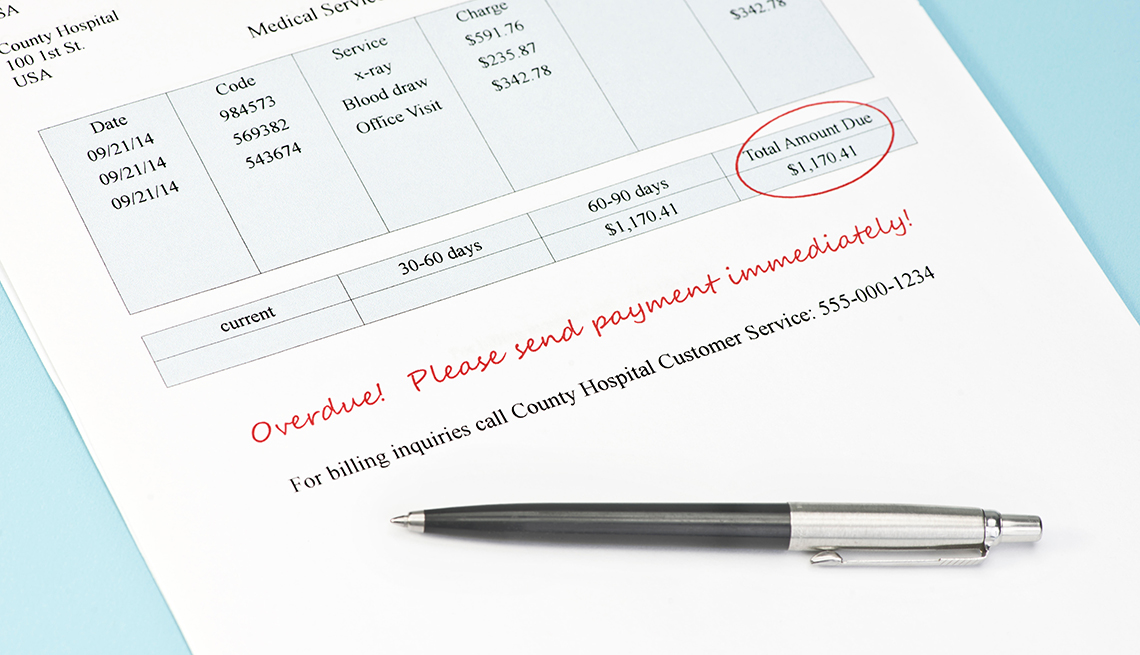

Medical bills on your credit report can hamper your ability to borrow money or gain employment and you can be sued for the debt which could result in a debt collection lawsuit wage garnishment or bank levy. I was past the final due date. The same survey found that 24 didnt even know they owed the bill and 13 said they never received the medical bill.

Address your concerns with the Better Business Bureau 3 days after you send the dispute letters. First you can dispute with the credit bureaus directly online. Collection agencies dont want to litigate.

I was going to get a balance of 500 paid in the next couple of months. I immediately went to the hospital billing office and asked to speak to the supervisor. If a medical collections account on your credit report is incorrect you can dispute the item.

Since I had already about 5000 I thought I would be good. Hospitals can sue their patients for unpaid medical bills but they cannot really send you to jail. Contact the provider and your insurance company.

Before and after your medical bill goes to collections try to negotiate your bill to make it easier to pay. If a hospital or other healthcare provider sent your medical bill to a collection agency dont pull out the credit card or checkbook just yet. Until I got the collection letter.

Yes unpaid medical bills can turn into legal action when the collections agency cannot get any payment or at least an intention to pay from you. They should push back the due date for your bill while an appeal is filed and that way it wont get sent to collections without you knowing it. However theyre only allowed to include information about the financial aspects of the debt.

A big part of this is the fact that they are confusing and intimidating and people rarely dispute them despite many bills being negotiable. Before you pay ask yourself or the debt collector these 6 important questions. So when I was recently faced with large medical bills.

Ignoring the debt wont make it go away and it could make the situation worse unless the statute of limitations on medical debt has already expired. You have a right to appeal charges that you believe are incorrect or.

/remove-debt-collections-from-your-credit-report-960376_FINAL-5ae6517517024613885ec46df1e58ecd.png) Remove Debt Collections From Your Credit Report

Remove Debt Collections From Your Credit Report

How Medical Bills Affect Your Credit Score

How Medical Bills Affect Your Credit Score

How To Dispute A Medical Bill Creditrepair Com

How To Dispute A Medical Bill Creditrepair Com

Sample Letter Disputing Debt Sample Business Letter

How To Remove Medical Collections From Your Credit Report 2021 Badcredit Org

How To Remove Medical Collections From Your Credit Report 2021 Badcredit Org

Debt Agency Letter Collection Dispute Template Medical Bill For Old Hudsonradc

Debt Agency Letter Collection Dispute Template Medical Bill For Old Hudsonradc

The Ultimate Guide To Disputing A Medical Bill To Reduce Your Payment

The Ultimate Guide To Disputing A Medical Bill To Reduce Your Payment

Hospital Bill Dispute Service Dismissing Hospital Bills Medical Debt In Collections Since 2013

Hospital Bill Dispute Service Dismissing Hospital Bills Medical Debt In Collections Since 2013

How To Dispute A Medical Bill And Win How I Beat Unethical Backbilling

How To Dispute A Medical Bill And Win How I Beat Unethical Backbilling

Hospital Bill Dispute Service Dismissing Hospital Bills Medical Debt In Collections Since 2013

Hospital Bill Dispute Service Dismissing Hospital Bills Medical Debt In Collections Since 2013

The Ultimate Guide To Disputing A Medical Bill To Reduce Your Payment

The Ultimate Guide To Disputing A Medical Bill To Reduce Your Payment

Have Medical Bills In Collections Dispute A Medical Bill With These 6 Tools

Have Medical Bills In Collections Dispute A Medical Bill With These 6 Tools

Steps To Disputing A Surprise Medical Bill

Steps To Disputing A Surprise Medical Bill

Have Medical Bills In Collections Dispute A Medical Bill With These 6 Tools Debt Relief Programs Medical Billing Debt Relief

Have Medical Bills In Collections Dispute A Medical Bill With These 6 Tools Debt Relief Programs Medical Billing Debt Relief

Comments

Post a Comment