How To Avoid The Irs

You can do that by making sure your withholding equals. How to Calculate Estimated Tax Payments.

How To Detect Irs Imposter Scams

How To Detect Irs Imposter Scams

You owe less than 1000 in taxes after subtracting.

How to avoid the irs. You can avoid a levy by filing returns on time and paying your taxes when due. Dont hide crypto profits from the IRS. Legally reducing your amount of taxable income or amount of tax owed.

Bear in mind that you need to have enough tax withheld throughout the year to avoid underpayment penalties and interest. You had an. You had a refund from the previous year credited to the current years estimated payments.

Do not send it to the IRS. To avoid or at least minimize failure to pay penalties pay your tax in full by the tax deadline even if you request an extension. In other words youve overpaid the government during the tax year and your refund makes you whole come tax time.

To avoid this refer to the letters that the IRS sent to your home stating how much money you received which are Forms 1444 and 1444-b. To have income tax withheld on government payments including social security benefits or unemployment benefits complete Form W-4V from the IRS website and send it to the payer. Generally you can avoid an underpayment penalty in the following scenarios.

When a taxpayer has an overdue tax bill To secure a delinquent tax return or a delinquent employment tax payment or. Instead of skipping taxes you should look to minimize what you owe. You can have 7 10 15 or 25 withheld from most government payments.

A tax refund happens when youve paid more than you legally owe to the IRS. You can only have 10 withheld from unemployment payments. So dont ignore IRS billing notices.

If you cant find them check your bank statements to make. To tour a business for example as part of an audit or during criminal investigations. Ordinarily you can avoid this penalty by paying at least 90 percent of your tax during the year.

If you need more time to file you can request an extension. You can also avoid interest or the Estimated Tax Penalty for paying too little tax during the year. The moral of the story is.

If you cant pay what you owe you should pay as much as you can and work with the IRS to resolve the remaining balance. If you owe more than you can afford to pay pay as much as possible by the deadline then pay the rest as soon as you can. Depending on your eligibility for deductions and credits you may be lucky enough to eliminate your tax bill completely but dont bank on it.

Underpaying your taxes wont always result in an actual penalty. This will help you avoid a surprise tax bill when you file your return. You should also be wary of thinking that cryptocurrency makes it easy for you to keep profits or income anonymous and get away with defrauding the IRS.

How the IRS initiates contact. There are many tax deductions and tax credits you can take advantage of to lower your tax bill. You didnt figure your estimated tax payments until after April 15 which is past the due date for the first payment and you only have 3 quarters left.

Making quarterly estimated tax payments during the year. Legal methods you can use to avoid paying taxes include things such as tax-advantaged accounts 401ks and IRAs as well as claiming tax credits and tax deductions. The key is to be proactive.

How To Avoid Irs Penalties When Offshore Youtube

How To Avoid Irs Penalties When Offshore Youtube

How To Avoid Problems With The Irs Sheppard Law Office

How To Avoid Problems With The Irs Sheppard Law Office

How To Avoid The Irs From Taking A Second Look The Best Money Strategies

How To Avoid The Irs From Taking A Second Look The Best Money Strategies

I Was Audited By The Irs And The Red Flags To Avoid An Irs Audit

I Was Audited By The Irs And The Red Flags To Avoid An Irs Audit

Opinion One In 5 Taxpayers Risk A Penalty From The Irs For Withholding Too Little In Taxes For 2018 Here S How You Avoid It Marketwatch

Opinion One In 5 Taxpayers Risk A Penalty From The Irs For Withholding Too Little In Taxes For 2018 Here S How You Avoid It Marketwatch

Irs Audit Triggers 10 Red Flags To Avoid Liberty Tax

6 Ways To Avoid A Tax Audit By The Irs Marketwatch

6 Ways To Avoid A Tax Audit By The Irs Marketwatch

Why Do I Owe Taxes How To Avoid Owing Money To The Irs

Why Do I Owe Taxes How To Avoid Owing Money To The Irs

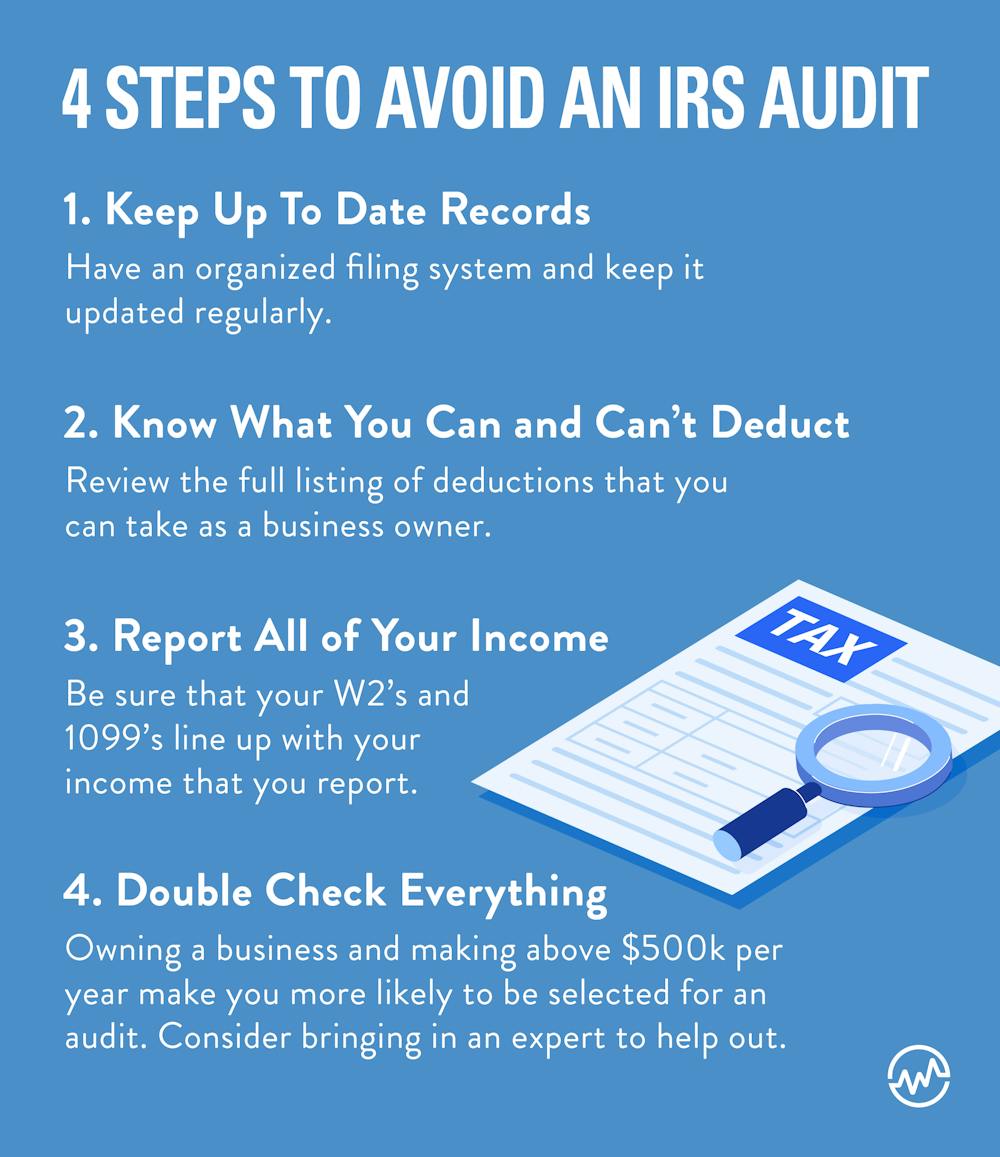

How To Avoid An Irs Audit Wealthfit

How To Avoid An Irs Audit Wealthfit

Best Practices For Avoiding An Irs Tax Audit Or Getting Through One

Best Practices For Avoiding An Irs Tax Audit Or Getting Through One

How To Avoid The Irs Underpayment Penalty Xscapers

How To Avoid The Irs Underpayment Penalty Xscapers

How To Avoid Irs Tax Audit Red Flags For The Irs Odds Of Getting Audited By The Irs Youtube

How To Avoid Irs Tax Audit Red Flags For The Irs Odds Of Getting Audited By The Irs Youtube

Irs Tax Underpayment Penalties And How To Avoid Them

Irs Tax Underpayment Penalties And How To Avoid Them

Comments

Post a Comment